Each year Business Software Solutions releases an update to the federal tax tables for our payroll module. This update will ensure that your FICA tax tables are set up correctly. In addition to updating the FICA tables, there are additional federal rates that may need to be changed manually. This year the employee contribution to social security will be increasing from 4.2% to 6.2%. Be sure to update this rate before you run payroll for the new year. To change this rate, do the following:

- 1. Open the BPA software and go to Business System>Payroll

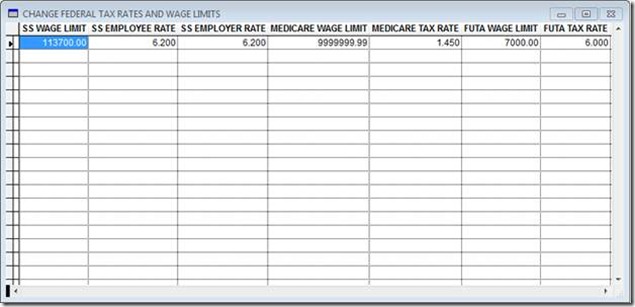

- 2. Click Change Federal Tax Limits

- 3. Ensure all rates are updated to the follow: SS Wage Limit – 113700.00, SS Employee Rate – 6.2, SS Employer Rate – 6.2, Medicare Wage Limit – 9999999.99, Medicare Tax Rate – 1.45, FUTA Wage Limit – 7000.00, FUTA Tax Rate – 6.000.

- 4. Once you have updated the rates simply select F3 to exit.

We also suggest that you check your SUTA tax rates by clicking Change State Tax Limits. Check with your state to enter the correct value here.

Please note that these rates may change at any time due to new federal legislation. Please check IRS Publication 15for updated rate information.