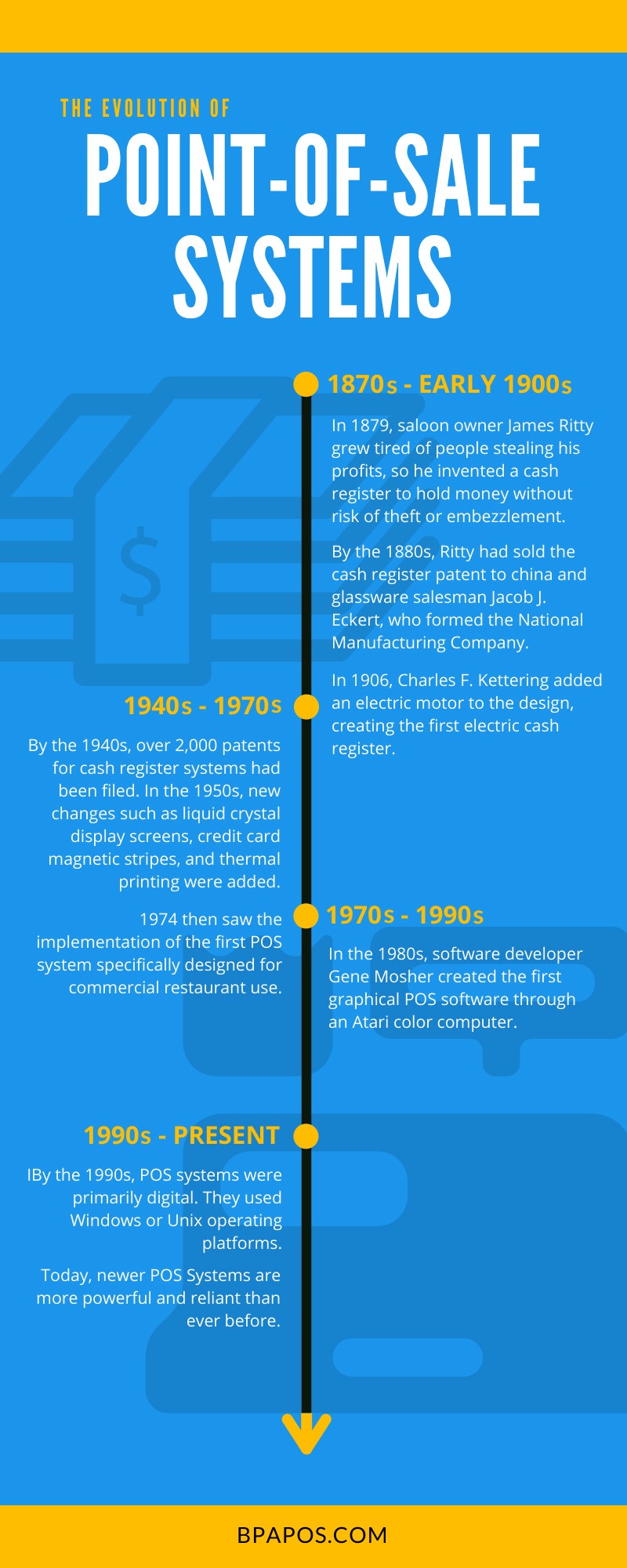

From early cash registers to modern tablets, point-of-sale (POS) systems have changed tremendously. They allow a smooth retail transaction between merchants and customers through the purchase, invoice, and payment option. Coins, paper money, credit cards, and now wireless transactions have changed the business world. The evolution of point-of-sale systems has occurred for over 140 years since the first cash register in 1879.

1870s-early 1900s

America was in disarray following the Civil War. People were stealing, robbing, or swindling money and other loot to make up for lost assets. In 1879, saloon owner James Ritty grew tired of people stealing his profits, so he invented a cash register to hold money without the risk of theft or embezzlement. These early machines were mechanical adding machines. After each transaction, employees would hit the total key, which rang a bell and signified a sale.

By the 1880s, Ritty had sold the cash register patent to china and glassware salesman Jacob J. Eckert, who formed the National Manufacturing Company. Eckert then sold the company to John H. Patterson, who renamed it the National Cash Register Company. Patterson expanded on the cash register with a paper roll to record sales transactions. This created a log for internal bookkeeping purposes as well as a receipt system. Receipts were essential for tracking transactions and making sure there was no embezzlement. They showed how much customers were charged and how much change they were given, and they also stopped people from making false purchase claims.

In 1906, Charles F. Kettering added an electric motor to the design, creating the first electric cash register. This made ringing up sales easier for sales clerks. Additionally, Kettering perfected a credit approval system, which allowed a central office to check consumer records and extend credit.

1940s-1970s

By the 1940s, over 2,000 patents for cash register systems had been filed. In the 1950s, new changes such as liquid crystal display screens, credit card magnetic stripes, and thermal printing were added. In 1958, Bank of America launched the first successful modern credit card in Fresno, California. This forced merchants to accept the card, and other banks were soon creating their own cards. However, using these cards was tricky and time-consuming, as merchants had to contact the banks for approval.

The 1970s saw the first modern POS system. In 1973, IBM released some store systems that were functionally a mainframe computer that used a store controller for IBM 3653/3663 POS registers. This was the first commercial use of client-server technology, peer-to-peer communications, local area network simultaneous backup, and remote initialization. Department stores began implementing these by the mid-1970s. That same year, the first computerized credit card system was created, allowing sales transactions to take place in less than one minute. 1974 then saw the implementation of the first POS system specifically designed for commercial restaurant use. One of the first microprocessor-controlled cash register systems was designed for McDonald’s restaurants using Intel processors. Workers pressed numeric keys to register respective food items for the order. Multiple orders could be placed at once, and totals were calculated with sales tax. This allowed managers to see the amount of money that should’ve been in the drawers.

1970s-1990s

In the 1980s, software developer Gene Mosher created the first graphical POS software through an Atari color computer. It had a touch screen interface based on different-colored widgets representing menu items. It was eventually installed in restaurants throughout North America. Soon after, IBM released its own graphical POS equipment that used a real-time, multiuse operating system.

1990s-Present

By the 1990s, POS systems were primarily digital. They used Windows or Unix operating platforms. These systems were reasonably priced, relied on local processing power, used local data storage, and made networking and graphical user interface common. These POS systems were further customized to fit the required business model.

Today, newer POS Systems are more powerful and reliant than ever before. Touch screen tablets and laptops offer portability and versatility that traditional POS terminals cannot. Not to mention, newer systems include high and consistent operating speeds, easy user interface, and remote supportability, and they’re relatively cost-effective. Still, sometimes issues occur. Database errors or compatibility issues can emerge with computer operating systems. The constant data input and calculations can lead to freezing, bugging, and crashes. It’s important that all POS systems and mainframe systems are regularly updated to mitigate these issues.

On top of software issues, POS systems are still susceptible to theft and security breaches. Dishonest employees can bypass items and steal. Returns and exchanges can also create loopholes in inventory and revenue, as this would eradicate the original sale. Employees can also exploit systems to steal money. A security system, such as cameras or alarms, can prevent some of these issues. Managers should also monitor all sales receipts to stop suspicious activity. Passwords must secure any database knowledge to prevent tampering. Additionally, hackers do target POS terminals since they process sales transactions and money. They can exploit vulnerabilities in the terminals and steal credit and debit card information, change prices of goods, steal customer data, and even take control of the POS system entirely.

Modern POS systems offer exceptional features on top of the typical sales and finances. They’re software-based rather than hardware-based like the systems of the 1970s and 1980s; these software systems offer inventory management, stock counting, vendor ordering, customer loyalty, purchase orders, stock transferring, quotation issuing, barcode creating, bookkeeping, accounting, and/or reporting features. These features are interlinked for maximized usability.

Standardized transactions have evolved from those made in general and department stores in the 1870s. Now, many different industries utilize these POS systems. Restaurants, retailers, wholesale and hospitality industries, property leasing businesses, repair shops, health care management, and ticketing offices are some examples. Some companies have switched to handheld POS systems rather than a stationary terminal. These are designed for transactions to take place in any part of the store rather than at one sales counter.

At Business Software Solutions, Inc., we have the best retail accounting software for your business. Our retail POS systems offer integrated credit card processing, inventory, bar code printing, and complete accounting systems. Plus, our Touch POS software is fast and easy to use, and it offers top-notch security for internal and external threats. Contact our experts for the best locally installed database and software around.